Importing goods into Nigeria involves navigating a complex system of charges, levies, and regulatory fees imposed by various government agencies and private entities. These charges significantly impact the cost of doing business and must be factored into pricing and logistics planning. Understanding these charges can help importers avoid unnecessary delays, penalties, and financial losses. In this article, we will break down the key charges levied on importers in Nigeria.

1. Customs Duty

Customs duty is a major charge imposed on imported goods. The Nigeria Customs Service (NCS) determines this duty based on the Harmonized System (HS) Code of the product. The rates vary between 5% and 35% of the Customs Value of the goods, which includes the Cost, Insurance, and Freight (CIF) value.

2. Value Added Tax (VAT)

A 7.5% VAT is applied to the total value of the goods, including CIF, customs duty, and other applicable charges.

3. Surcharge and Levies

Importers are subject to additional levies and surcharges, such as:

- Comprehensive Import Supervision Scheme (CISS) Fee – 1% of FOB (Free on Board) value, charged for pre-shipment inspection.

- ECOWAS Trade Liberalization Scheme (ETLS) Levy – 0.5% for imports from ECOWAS countries.

- National Automotive Council (NAC) Levy – 35% for imported vehicles.

- Excise Duty – Applied to certain goods, such as alcohol and tobacco.

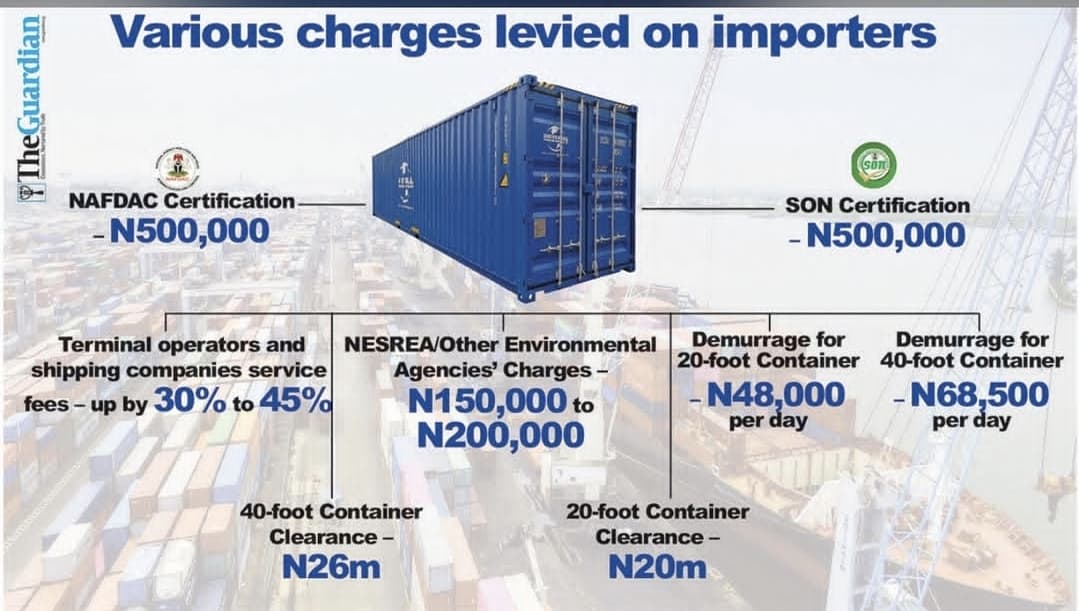

4. Port and Terminal Charges

Importers pay various fees for cargo handling at Nigerian ports, including:

- Terminal Handling Charges (THC) – Covers loading/unloading containers at the port.

- Wharf Landing Fees – Paid to state governments (e.g., Lagos Wharf Landing Fee: ₦500 – ₦1,000 per container).

- Port Storage Fees – Applies if cargo is not cleared within the free storage period.

5. Shipping and Logistics Fees

- Freight Charges – Varies depending on the shipping method and distance.

- Shipping Line Charges – Paid to shipping companies for transporting goods.

- Container Deposit – A refundable deposit paid for using shipping line containers, refunded after timely return.

6. Customs Processing and Administrative Fees

- Form M Processing Fee – Charged by banks for opening Form M (import declaration form).

- Pre-Arrival Assessment Report (PAAR) Fee – Paid for customs assessment of cargo.

- Customs Examination Fees – Applies when goods require additional inspection.

7. Demurrage and Storage Fees

Failure to clear goods on time results in:

- Port Demurrage Charges – Imposed by the Nigerian Ports Authority (NPA) and terminal operators.

- Shipping Line Demurrage – Incurred when containers are not returned within the stipulated period.

- Warehouse Storage Fees – Applied to goods stored in customs or bonded warehouses.

8. Regulatory and Inspection Charges

Certain goods require inspection and approval from regulatory agencies:

- NAFDAC Fees – For importing food, drugs, cosmetics, and chemicals.

- Standards Organization of Nigeria (SON) Fees – For product quality compliance.

- Nigeria Agricultural Quarantine Service (NAQS) Fees – For agricultural imports.

9. Security and Insurance Fees

- Marine Insurance – Covers goods against damage or loss during shipment.

- Cargo Tracking Note (CTN) Fee – Required for monitoring imports.

10. Penalties and Additional Charges

Failure to comply with customs regulations may attract fines and penalties, including:

- Late Form M Processing Penalty

- Incorrect Documentation Fines

- Seizure and Auction Fees for Contraband Goods

Conclusion

Importing into Nigeria comes with several financial obligations that impact overall business costs. Importers must stay informed about these charges and ensure compliance with regulations to avoid unnecessary expenses. By understanding and planning for these costs, businesses can effectively manage their importation processes while minimizing risks and delays.

For a seamless import experience, consider working with licensed customs brokers and logistics experts to navigate these complexities efficiently.